trust capital gains tax rate 2019

Person effectively elects to include in each years income hisher pro rata share of the PFICs ordinary earnings and net capital gainsIf a QEF election is. The first payment for a.

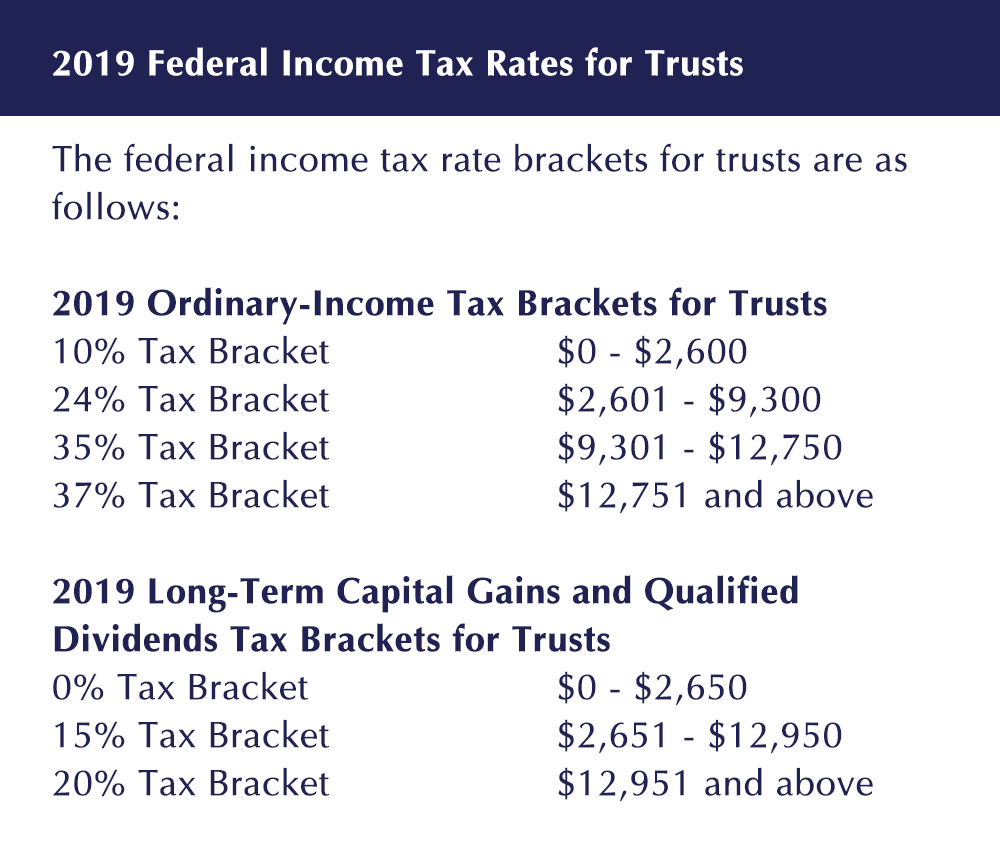

Estimated 2019 Tax Brackets And Exemption Amounts For Trusts And Estates Preservation Family Wealth Protection Planning

Income over 12500 is taxed at a rate of 37 percent while capital gains and qualified dividends over 12700 are taxed at a rate of only 20 percent.

. 2022 Long-Term Capital Gains Trust Tax Rates. A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Like any asset in your name any gain on the asset will also be.

For tax year 2019 the 20 rate applies to amounts above 12950. 4 rows Guidance about the tax-free allowance and telling HMRC about capital gains made by a trust. The following Capital Gains Tax rates apply.

Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. Use that to realize gains without paying a tax. HS294 Trusts and Capital Gains Tax 2019 This helpsheet explains how UK resident trusts are treated for Capital Gains Tax.

There is a 0 tax rate on long-term capital gains for many taxpayers. However long term capital gain generated by a trust still. The maximum tax rate for long-term capital gains and qualified dividends is 20.

If your trust was taxed as a separate entity the tax rate would be much higher and your tax bill would be greater. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Estimated Payments for Taxes.

For tax year 2019 the 20 rate applies to amounts above 12950. Under the QEF election the US. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to.

Capital gains and qualified dividends. 255 plus 24 of the excess over 2550. The 0 and 15.

2022 Long-Term Capital Gains Trust Tax Rates. A trust may only have up to 2650 in 2019. The average rate for 2021 was.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. The tax rate on most net capital gain is no higher than 15 for most individuals.

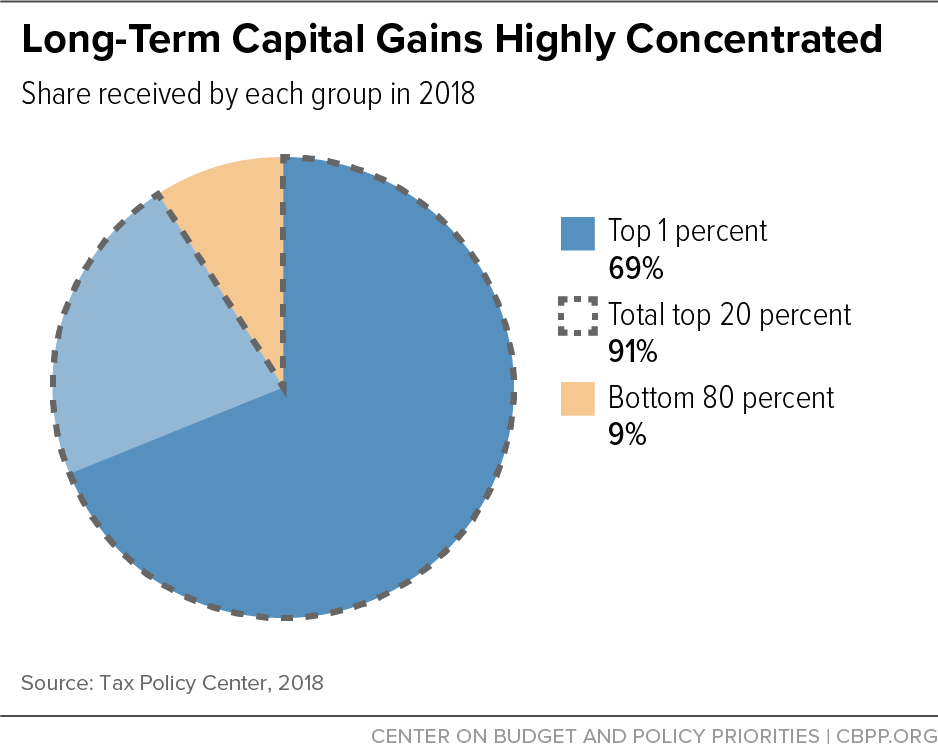

Individuals also enjoy a substantial benefit over trusts when it comes to the income taxation of capital gains and qualified dividends. It also deals with situations where a person disposes of an. Most investors pay capital gains taxes at lower tax rates than they would for ordinary income.

1839 plus 35 of the excess over 9150. For example the top ordinary Federal income tax rate is 37 while the top. The difference is likely.

Capital gains and qualified dividends. This means youll pay 30 in Capital. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest.

18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work. For tax year 2021 the 20 maximum capital gain rate applies to estates and trusts with income above 13250.

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

The Highway Trust Fund Explained

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Solved Required Information The Following Information Chegg Com

Trust Tax Rates And Exemptions For 2022 Smartasset

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Income Tax And Capital Gains Rates 2020 Skloff Financial Group

An Overview Of Capital Gains Taxes Tax Foundation

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Tax Issues When Winding Up The Estate Of A Loved One Hantzmon Wiebel Cpa And Advisory Services

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

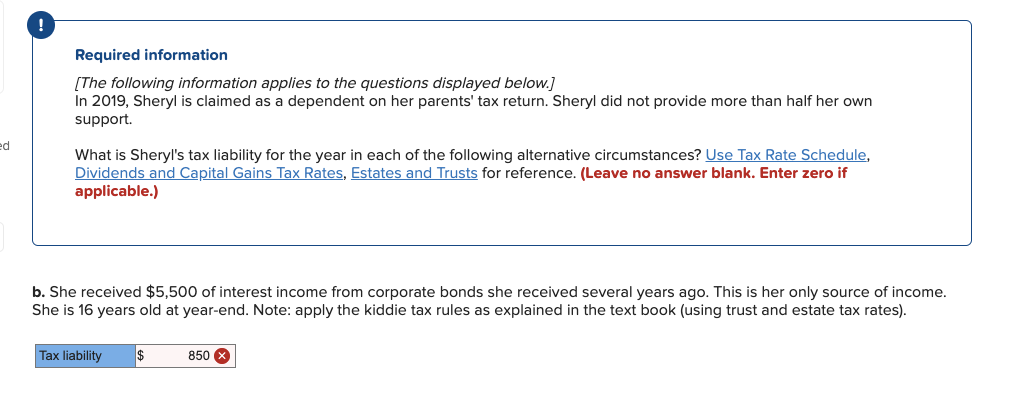

Solved Required Information The Following Information Chegg Com

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Annuity Vs Mutual Funds Which Is Right For You 2022

Income Taxation Of Trusts And Estates After Tax Reform

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes